April 22, 2003

Midterm #2 Answers

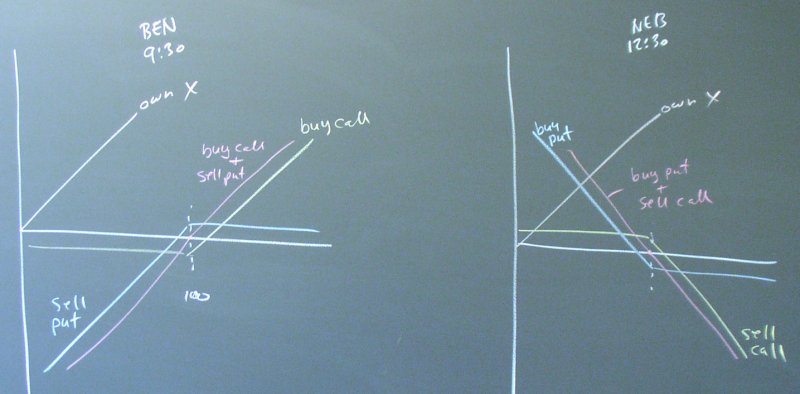

#10. Ben and Neb construct mirror image portfolios that change in value one-for-one with X without any initial investment. These are thus highly leveraged positions. If X goes down, Ben has to pay on the put option. If X goes up, Neb has to pay on the call option.

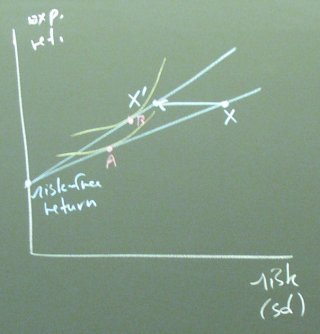

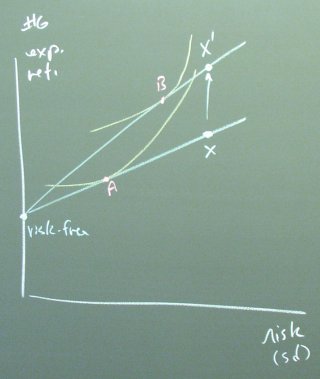

#6 (9:30). When the expected return increase, X goes up.

#9 (12:30). When the risk goes down, X goest left.