November 18, 2003

Getting Ready for MT 2

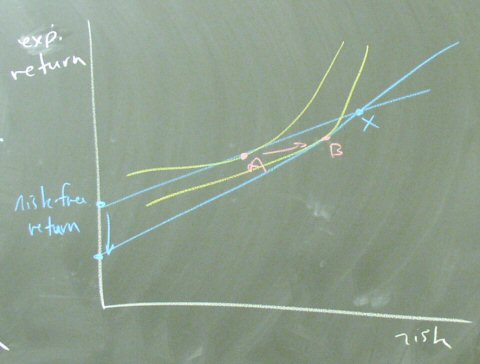

What happens to the optimal portfolio if the return the risk-free asset falls?

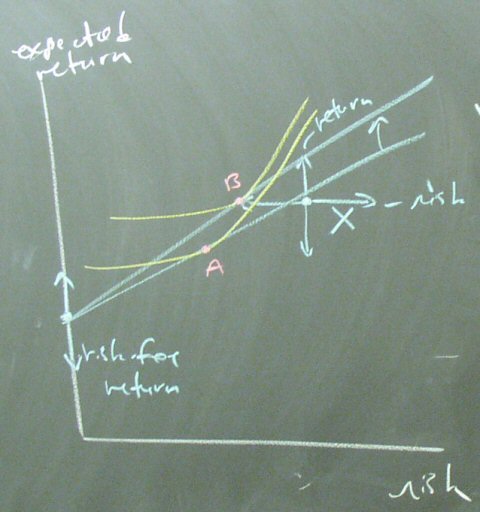

There are basically six versions of this question. Here we see in increase in the expected return on the risky asset.

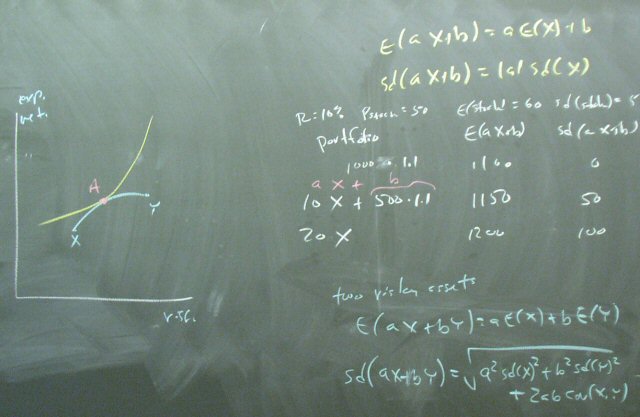

Demonstate the two equations that we use to construct the budget constraint in the diagram of risk vs. expected return.

We also revisited the explanation of why we do not spend serious time working on the case of more than one risky asset.

Posted by bparke at November 18, 2003 09:16 PM