March 18, 2003

Futures and Options

Forward Contract - delivery of a commodity at a future date for a stated price.

Futures Contract - hypothetical delivery of a commondity at a future date for a stated price. The actual settlement is in dollars based on the realized commodity price in the newspaper.

Farmer Brown and a feedlot operator could both reduce their risk by entering into a forward contract to buy and sell corn in the future at an agreed on price.

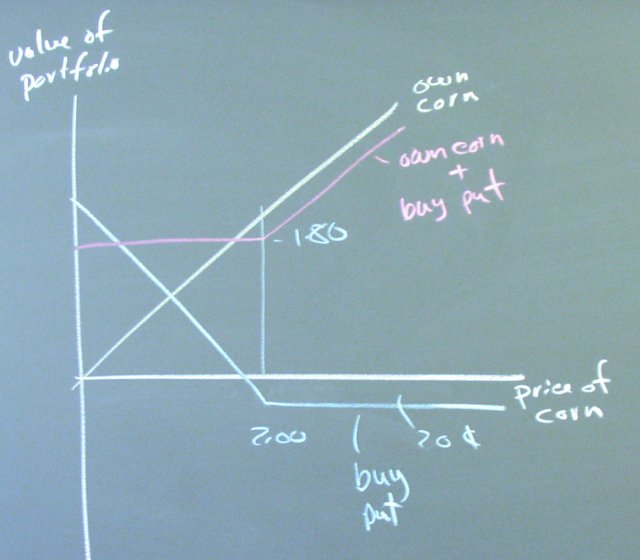

Farmer Brown could buy a corn put option (or a corn futures put option) with a strike price of 2.50 to reduce his risk from a low realized future corn price.

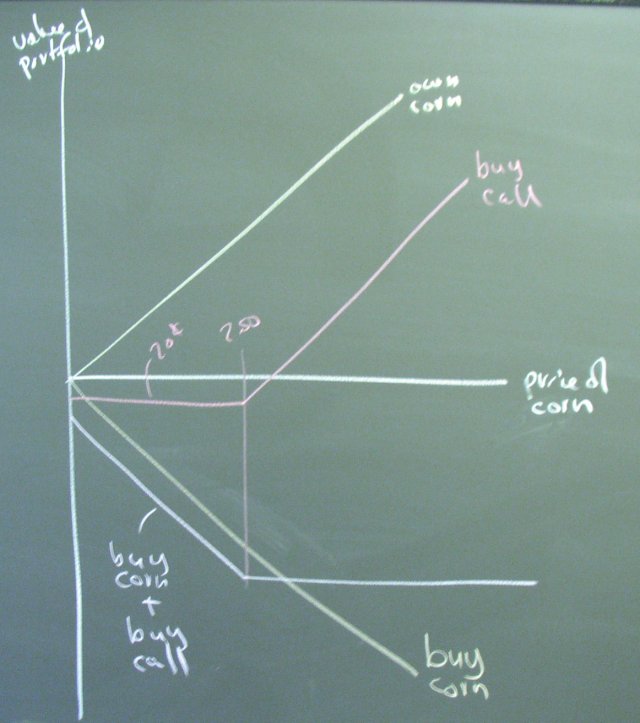

The feedlot operator could buy a corn call option (or a corn futures call option) to reduce his risk of a high future corn price.

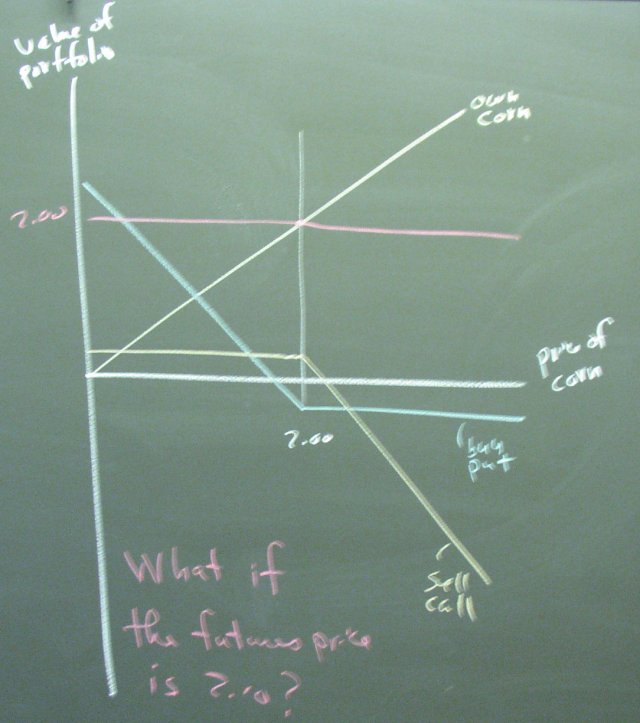

You can own corn, buy a put, and sell a call to construct a guaranteed outcome of 2.00 per bushel. If the price is 2.00, you sell the corn in the spot market. If the price is above 2.00, the call option gets exercised and you are forced to sell at 2.00. If the price is below 2.00, you exercise the put option.

How to make arbitrage profits: What if the future contract price of corn is 2.10?

Please spend some time studying the C Section of the WSJ to understand how the prices of futures and futures options show the market's forecast of the future price. Think about why the prices of options depend so greatly on the strike price.