November 18, 2003

Options

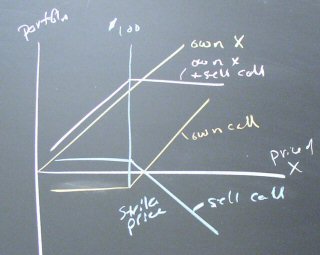

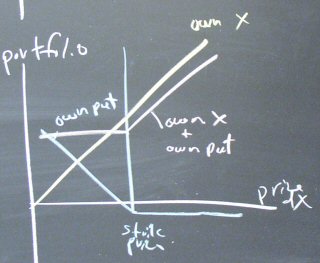

We did a few options diagrams, which now makes this diagram fair game for the midterm.

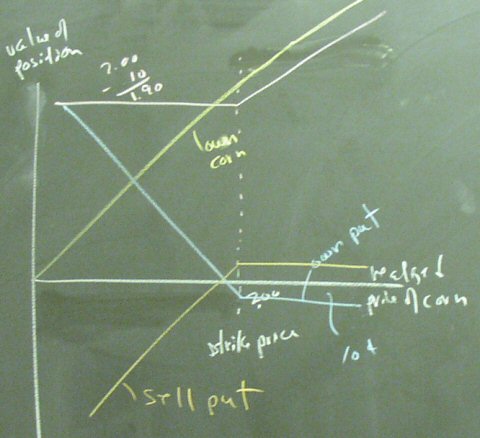

Own corn and buy a put option to lower your risk:

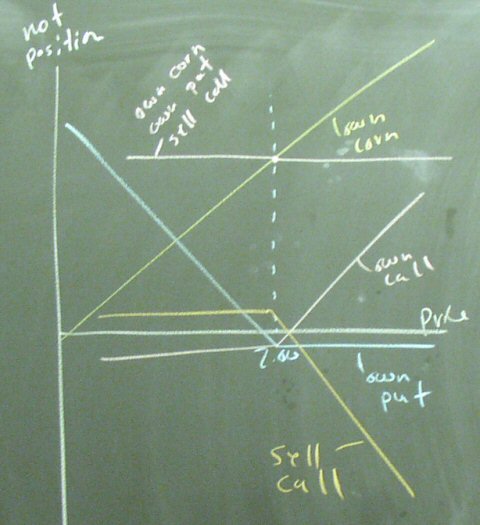

Own corn, buy a put, and sell a call to construct a risk-free position. The prices of options will adjust in the markets to squeeze out potential arbitrage profits (economists' view). There are huge arbitrage profits out there (MBA view). Historical footnote: Long-Term Capital Management tried to secure these arbitrage profits and nearly brought down the world's financial markets when they failed. (See The Econ Review when the LTCM story is featured.

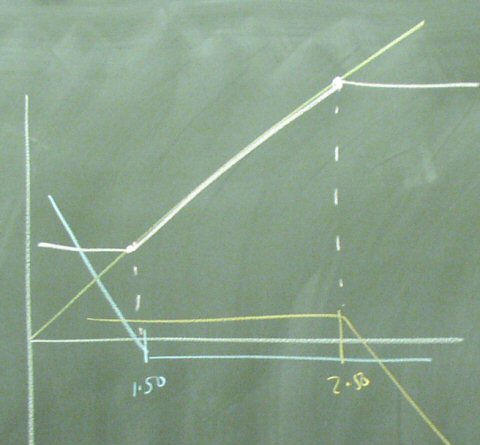

In the real world, the strike prices on the call and put options could be different, giving flexible strategies for dealing with risk.

Later in the afternoon, we got some nice pictures from Murphey Hall.

Reducing risk a bit by owning corn and sell a call option:

Reducing risk by owning corn and buying a put option:

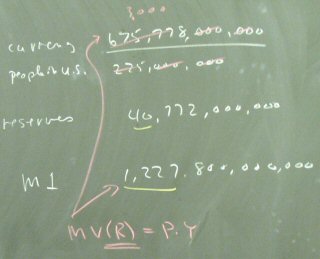

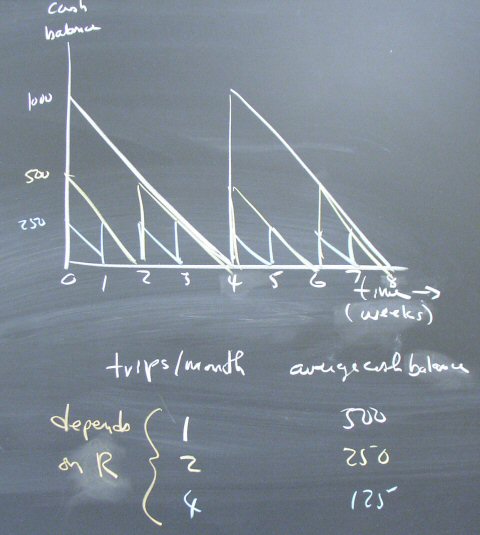

The Transactions Demand for Money - II

We looked into the amount of currency in circulation and were unable to square the amount with the fable about shoe leather and trips to the bank.

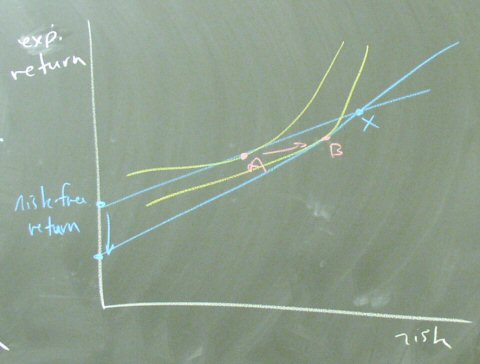

Getting Ready for MT 2

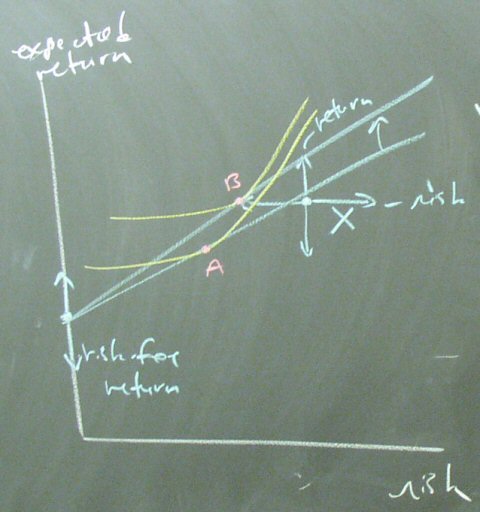

What happens to the optimal portfolio if the return the risk-free asset falls?

There are basically six versions of this question. Here we see in increase in the expected return on the risky asset.

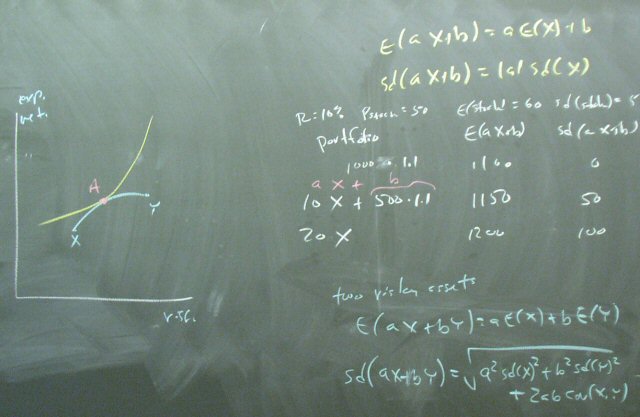

Demonstate the two equations that we use to construct the budget constraint in the diagram of risk vs. expected return.

We also revisited the explanation of why we do not spend serious time working on the case of more than one risky asset.

Review Session

We journeyed to Murphey Hall and we quite impressed with the amenities, which included central air, chalkboards you can actually erase, and very nice furnishings.

We revisited "why the demand for money depends on the interest rate." Notice the nice photogenic chalkboard.

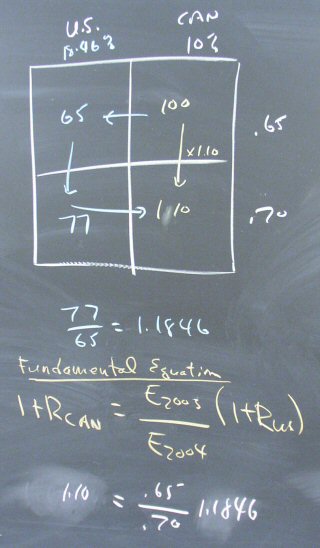

We determined the U.S. interest rate that is consistent with interest rate parity.

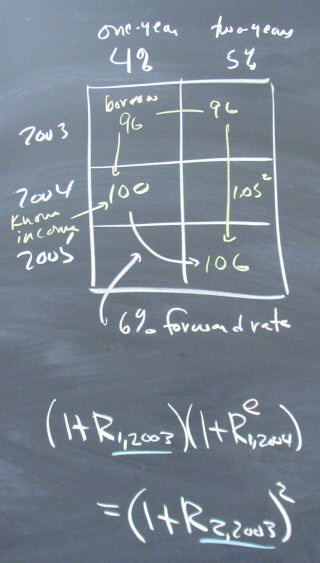

Comparing the forward rate calculations with the expectations hypothesis:

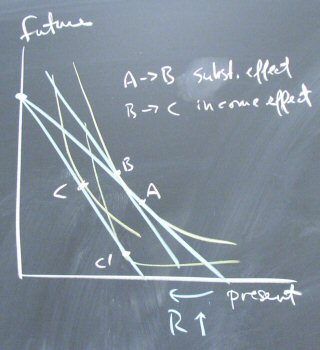

Would it be economics without an income and substitution effects diagram?