April 28, 2003

Monday's Review Session

Selected highlights.

Continue reading "Monday's Review Session"April 27, 2003

April 26, 2003

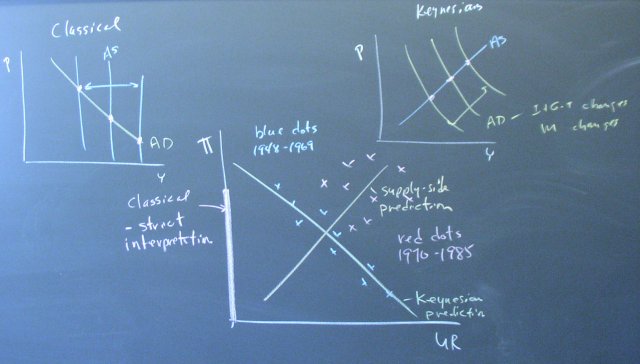

The Phillips Curve

To explain business cycles, the Classical Model relies on shifts in the aggregate supply curve and the IS/LM Model relies on shifts in the aggregate demand curve. A strict interpretation of the Classical Model is that the unemployment rate is always zero, implying a vertical Phillips Curve on the vertical axis. The Keynesian prediction, on the other hand, matches the data for 1948 to 1969 reasonably well.

The supply side economists emphasized the role of production in their extension of the Classical Model. This focus on production fit well with Phillips Curve data from 1970 to 1985.

Double-Dip?

The possibility that we will experience a "double-dip" recession seems a little less likely given the preliminary GDP number for the first quarter.

April 25, 2003

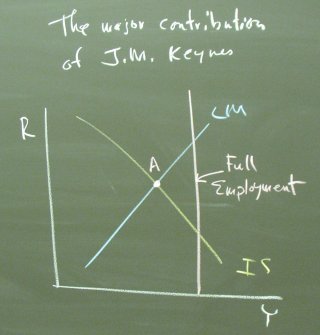

The Major Contribution of J.M. Keynes

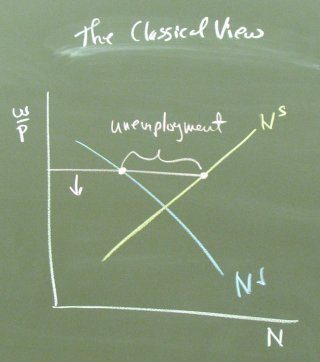

The Classical economists anchored their model on equilibrium in the supply and demand for labor. Unemployment, if it existed, was a temporary phenomenon caused by a real wage rate above the equilibrium value. The wage rate and/or the price level would adjust to eliminate the unemployment.

Keynes demonstrated that a stable equilibrium could exist in a model with no explicit reference to the labor market. The Keynesian equilibrium arose from adjustments in the interest rate, not the real wage rate. If the economy happened to be in equilibrium below full employment, no natural force existed to push the economy toward full employment.

The 25% unemployment rate that prevaled through much of the Great Depression seemed to provide conclusive evidence on the relative merits of the two models.

The major implication of the acceptance of the Keynesian model was that, if equilibrium could be stable with 25% unemployment, then the government should undertake fiscal and monetary policies to move the equilibrium toward full employment.

The data for the 1970's on the Phillips curve handout show that this issue is not settled. By 1980, there were substantial doubts that fiscal and monetary policies could be used to effectively steer the economy.

The Phillips Curve and the Classical Model

In considering the implications of the Classical Model and the IS/LM Model for the Phillips curve, we made a translation between output Y and the unemployment rate UR and between the price level P and the rate of inflation (pi).

A strict interpretation of the Classical Model would imply a vertical Phillips curve located on the vertical axis because the Classical Model implies an unemployment rate of zero.

We can introduce unemployment into the Classical Model in the form of frictional unemployment. That is, people are unemployed as they change jobs. In times of low Y, this period might be lengthy as it takes some time to find a good employment opportunity. In times of high Y, the time spent searching for a new job might be small. Some mechanism of this sort is needed to translation low levels of Y into high (nonzero) levels of unemployment.

April 23, 2003

OEQ

One student showed up for today's "office hours." Here are some highlights.

Continue reading "OEQ"April 22, 2003

The Classical Model

The Classical Model of Income and Employment was the leading view of business cycles before the Great Depression.

Continue reading "The Classical Model"April 19, 2003

The IS/LM Model

Here we derive the IS and LM curves and illustrate fiscal and monetary policy.

(This lecture was originally presented on April 3rd.)

The two key assumptions are that there is one interest rate in both the loanable funds market and the money market and that the price level is fixed. The first assumption is relaxed in the next lecture. Our discussion of the expectations hypothesis, risk premia, and the yield curve has already explored the value of the second assumption as a useful approximation.

Continue reading "The IS/LM Model"Animated Phillips Curve

Check out the animated Phillips curve at

www.econmodel.com/phillips/index.htm.

Aggregate Supply and Aggregate Demand

We allow the price level to change for the IS/LM Model, producing the aggregage demand curve. Adding an aggregate supply schedule allows us to study the relation between output and the price level.

Continue reading "Aggregate Supply and Aggregate Demand"April 16, 2003

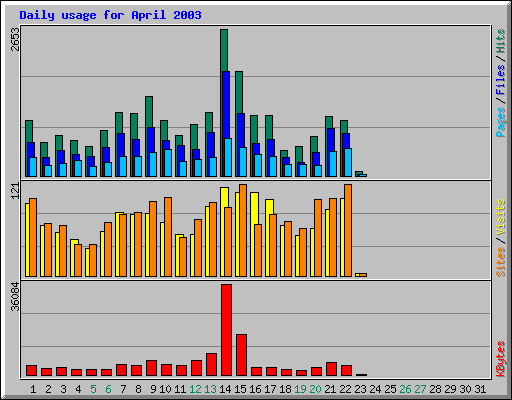

Usage Statistics

The econmodel.net web site contains the Econ 185 blog and some auxiliary web pages for the econmodel.com web site. The latter pages account for about two to four megabytes of downloads per day.

The bottom red bar graph shows megabytes downloaded by day. The day before our exam on April 15th, downloads were over 36 megabytes. The day of the exam (starting at midnight) downloads were over 16 megabytes.

The 40+ students in the two sections viewed this page about 300 times in the first two weeks of April and downloaded well over 1 megabyte per student of web pages and graphics on April 14th and 15th.

It is interesting that traffic did not show a major increase on April 12th and 13th. In particular, downloads the day of the exam (and one exam started at 9:30 a.m.) were greater than downloads on the 12th and 13th combined.

April 14, 2003

April 13, 2003

OEQ

Some highlights from Sunday's "office hours".

Continue reading "OEQ"